WATERLOO REGION, ON (February 2, 2024) — In January, there were 375 homes sold through the Multiple Listing Service® (MLS®) System of the Waterloo Region Association of REALTORS® (WRAR), representing an increase of 25.4 per cent compared to the previous year and a decline of 7.4 per cent compared to the previous 10-year average for the month.

“January is traditionally a slower time of year for home sales, but it’s reassuring to see the increase compared to last year,” says Christal Moura, president of WRAR. “This time last year, we hit an all-time low in January home sales, and while this year has begun with sales below the historical average, the market is showing signs of improvement.”

Total residential sales in January included 206 detached (up 15.7 per cent from January 2023), and 85 townhouses (up 39.3 per cent). Sales also included 56 condominium units (up 30.2 per cent) and 19 semi-detached homes (up 11.8 per cent).

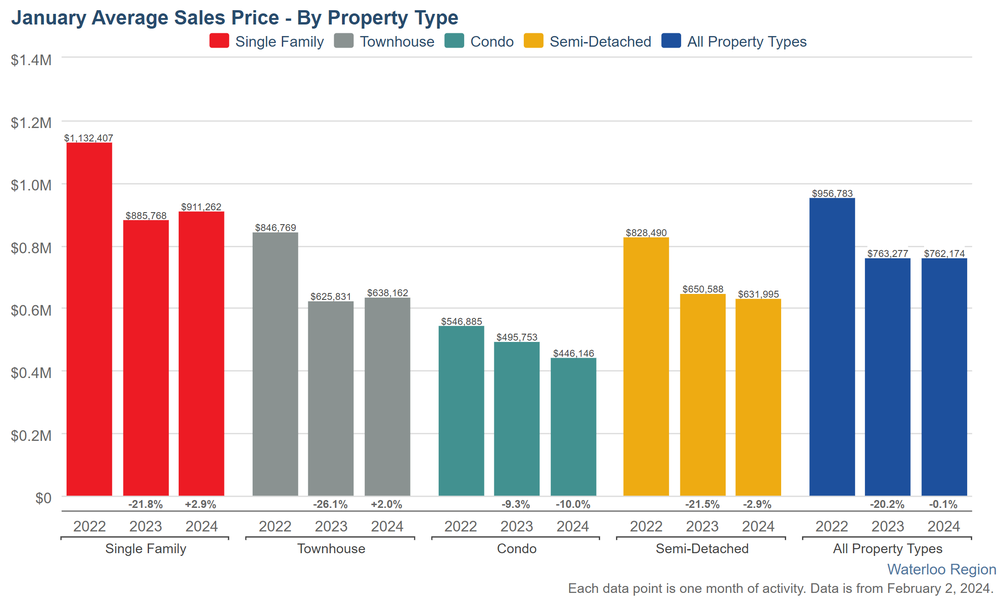

In January, the average sale price for all residential properties in Waterloo Region was $762,174. This represents a 0.1 per cent decrease compared to January 2023 and a 3.2 per cent increase compared to December 2023.

- The average price of a detached home was $911,262. This represents a 2.9 per cent increase from January 2023 and an increase of 7.5 per cent compared to December 2023.

- The average sale price for a townhouse was $638,162. This represents a 2.0 per cent increase from January 2023 and an increase of 2.7 per cent compared to December 2023.

- The average sale price for an apartment-style condominium was $446,146. This represents a decrease of 10.0 per cent from January 2023 and a decrease of 8.7 per cent compared to December 2023.

- The average sale price for a semi was $631,995. This represents a decrease of 2.9 per cent compared to January 2023 and an increase of 3.1 per cent compared to December 2023.

“We are optimistic that this year will have more stability than last,” says Moura. “With the Bank of Canada holding steady at a 5.0% benchmark interest rate, they recognize the overall economy has slowed down. However, housing is a key metric, and we expect the Bank to maintain a balanced response so long as housing continues with moderate growth in 2024 rather than any dramatic increases.”

President Moura points out that navigating shifting markets is a challenge and encourages consumers to work with a local REALTOR to ensure they receive the depth of local market knowledge required to protect their interests.

There was 720 new listings added to the MLS® System in Waterloo Region last month, an increase of 23.5 per cent compared to January last year and a 3.9 per cent decrease compared to the previous ten-year average for January.

The total number of homes available for sale in active status at the end of January was 855 an increase of 33.4 per cent compared to January of last year and 1.2 per cent below the previous ten-year average of 865 listings for January.

At the end of January, there were 1.5 months of inventory, a 50.0 percent increase compared to last year and 15.4 percent above the previous 10-year average. The number of months of inventory represents how long it would take to sell off current inventories at the current sales rate.

“With the exception of condo apartment property types, we saw mostly yearly and monthly price gains across the housing types,” says Moura. “This is because there is more supply in the condo segment (2.8 months) compared to the other property types.”

The average number of days to sell in January was 33, compared to 25 days in January 2023. The previous 5-year average is 20 days.

President Moura points out that navigating shifting markets is a challenge and encourages consumers to work with a local REALTOR to ensure they receive the depth of local market knowledge required to protect their interests.

There was 720 new listings added to the MLS® System in Waterloo Region last month, an increase of 23.5 per cent compared to January last year and a 3.9 per cent decrease compared to the previous ten-year average for January.

The total number of homes available for sale in active status at the end of January was 855 an increase of 33.4 per cent compared to January of last year and 1.2 per cent below the previous ten-year average of 865 listings for January.

At the end of January, there were 1.5 months of inventory, a 50.0 percent increase compared to last year and 15.4 percent above the previous 10-year average. The number of months of inventory represents how long it would take to sell off current inventories at the current sales rate.

“With the exception of condo apartment property types, we saw mostly yearly and monthly price gains across the housing types,” says Moura. “This is because there is more supply in the condo segment (2.8 months) compared to the other property types.”

The average number of days to sell in January was 33, compared to 25 days in January 2023. The previous 5-year average is 20 days.